The losers and winners in the 2020/2021 Kenyan budget

With Kenya’s economy still reeling from the ripple effects of Covid-19, the Treasury CS Ukur Yatani, did not have much good news for Kenyans. Yatani read his 2.7 trillion budget

With Kenya’s economy still reeling from the ripple effects of Covid-19, the Treasury CS Ukur Yatani, did not have much good news for Kenyans. Yatani read his 2.7 trillion budget at the National Assembly on Thursday afternoon.

Here is a breakdown of the losers and winners in the 2020/2021 budget. It will take effect on July 1, 2020.

READ ALSO: The best gifts for father’s day 2020

Losers in the 2020/2021 budget

Excise duty on spirits will go up. LPG gas, which was previously not on the taxman’s radar will now be taxed 14 per cent. This means that Kenyans will pay Sh300 more for cooking gas.

The import duty for electrical parts has also been increased to 35 per cent from 25 per cent. This will help support local manufacturers of electrical parts and accessories.

With many businesses shifting online during the current Covid-19 pandemic, the government wants also to tap into their revenue. Online businesses will remit a 1.5 per cent digital service tax on online transactions.

Home Ownership Savings Plans (HOSPs) will be taxed; this will reduce many people’s ability to own a home. Landlords making Sh15 million and below will have to surrender 10 per cent of their revenue to the government.

The monthly income of retirees and those employees who earn bonuses and overtime allowances will also be taxed.

However, the import duty for iron and steel products has been maintained at 35 per cent. The import duty for paper, leather and footwear manufacturers has been maintained at 25 per cent.

The government is aiming at collecting Sh38.9 billion from the new tax measures.

ALSO READ: DCI arrests three suspects in connection with Mercy Cherono’s assault

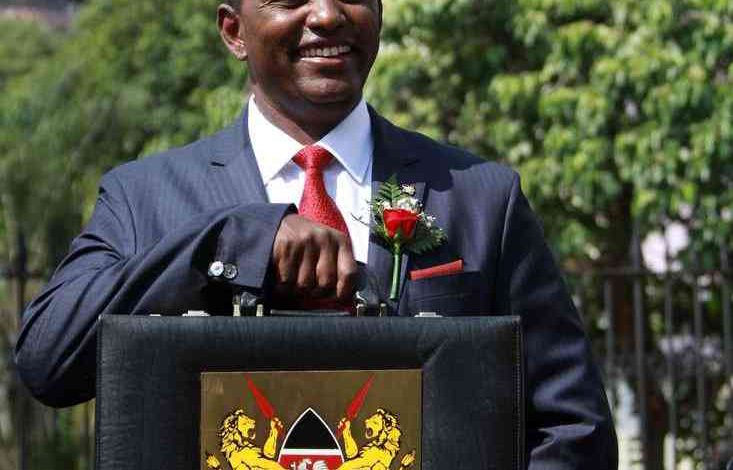

Treasury Cabinet Secretary Ukur Yatani poses for a photo with colleagues after reading the 2020/2021 budget on Thursday. [Source: Rick Okinda/Twitter]

Winners in the 2020/2021 budget

Some of the biggest winners in the new budget are the maize and corn farmers as the seeds will be exempted from VAT.

“Inputs for making baby diapers will be imported duty-free under the East African Community Duty Remission Scheme,” CS Yatani said.

Textile and apparel manufacturers will get their inputs duty free. Raw materials for the manufacture of masks, sanitizers, ventilators, overalls, face shields and other Covid-19 personal protective equipment will also be duty-free.

Ambulance, medical, nursing and dental services have been exempted from VAT. In addition, the treasury CS has allocated Sh50.3 billion towards universal health care.

The telecommunication industry is a happy lot as the mobile phone assemblers will no longer pay import duty.

The Kenya Defence Forces and the National Police Service will no longer pay import declaration fees and the railway development levy.

“These charges reduce budgetary allocations of these institutions,” CS Yatani said.

To help them get back on their feet, the tourism and hospitality sector will be given a Ksh30 bn soft loan.

The government has not forgotten the youth as it has set aside Sh10bn for the Kazi Mtaani Program.

The government will give Kenyans who have not paid taxes in the past five years a second chance.

“The programme will run for three years. In order to encourage uptake of this plan, I propose to grant relief for penalties and interest in respect of what has been disclosed after payment of the principal tax,” CS Yatani said.

DON’T MISS: Mutyambai does his work quietly – Charles Owino defends boss